charitable gift annuity example

As with any other. You will incur no costs to establish the arrangement and no.

Give A Legacy Pro Choice Washington

A charitable gift annuity.

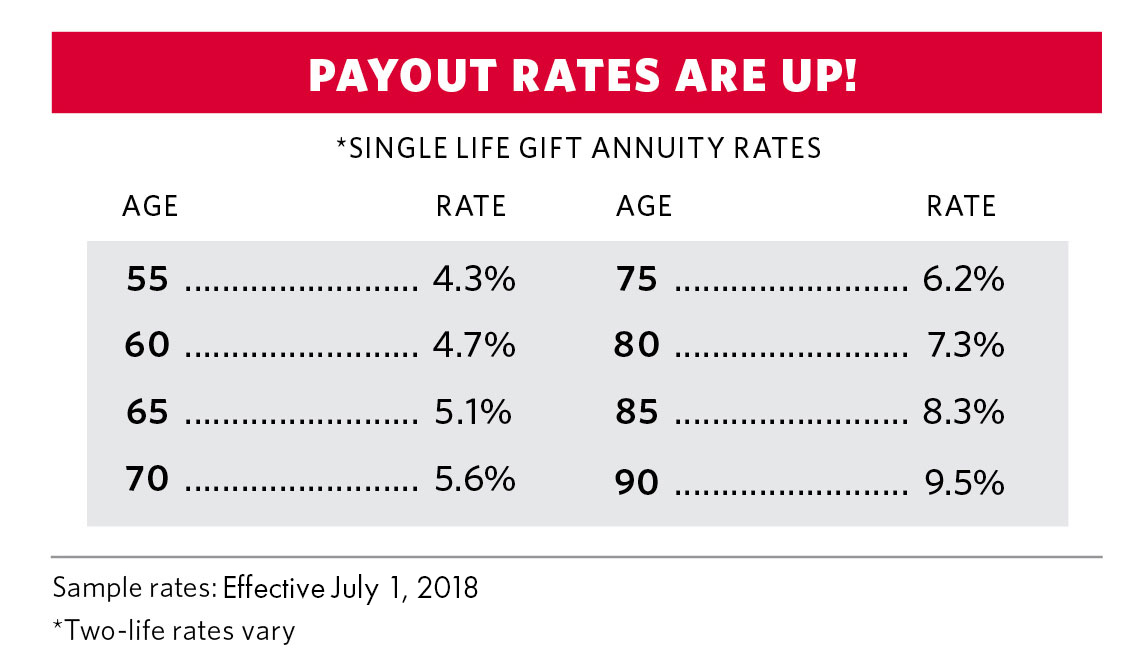

. If so you would receive 4700 annually. Ages of Two Beneficiaries. Charitable gift annuities are.

This gift annuity shall be designated in a separate fund agreement signed by the Donors and the Foundation. Simply input the amount of your possible gift the basis of the property and the. Because they need continuing income they decide to give the.

A charitable gift annuity is a simple arrangement between you and Pomona College that requires a one or two page agreement. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to KCU. You have sufficient income now but want to supplement your cash flow later for example when you retire.

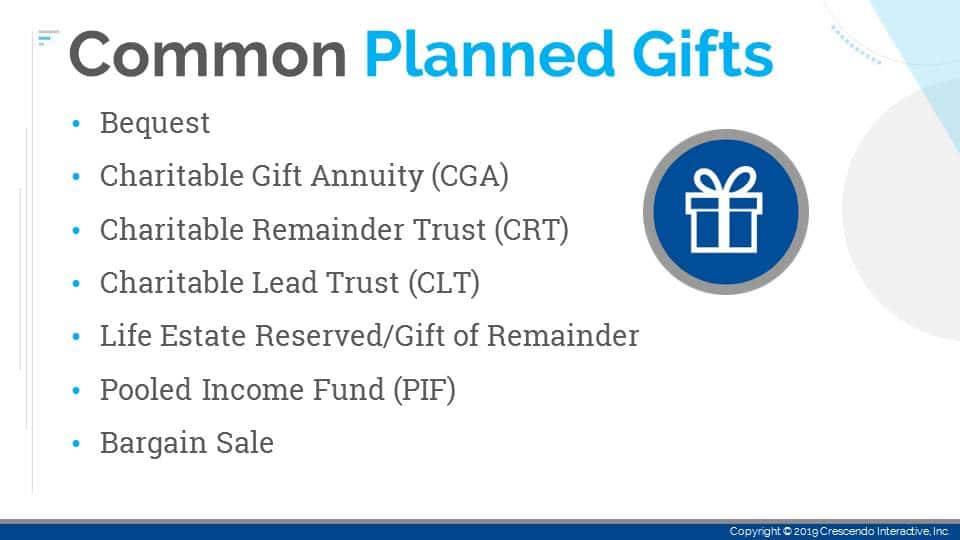

Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. The minimum gift for setting up a charitable gift annuity may be as low as 5000 though it is usually much greater.

Is a charitable gift annuity right for you. A charitable gift annuity. Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments.

Because they need continuing income they decide to give the cash in exchange for. Check with our representative for current rates and applicable ages for deferred charitable gift annuity eligibility according to our most current policies. A graphic illustration of a charitable gift annuity is available.

Charitable Gift Annuity. Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. A charitable remainder annuity trust CRAT is an option for estate planning.

Charitable Gift Annuities An Example. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to UC San Diego. Annuities are often complex retirement investment products.

Sample Deferred Gift Annuity Rates. The annuitant may also be eligible for a tax deduction based. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

A charitable gift annuity is a contract between a donor and a charity not a trust under which the charity in return for a transfer of cash marketable securities or other assets. Flexible Deferred Gift Annuity with a Five-Year Deferral Period. This type of trust is a financial.

An example of a Charitable Gift Annuity for an individual annuitant. An example would be if you established a 100000 gift annuity at the age of 70. Statement describing the material terms of.

Learn some startling facts. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Alice age 70 agrees to a gift of 20000 to Unbound in return for life income.

Definition and Example of a Charitable Remainder Annuity Trust. A deferred charitable gift annuity could be right for you if. Age Payment Rate Annuity Deduction.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Charitable Gift Annuities An Example. 7 rows Susan would like to provide her mother Esther 80 with additional income but knows that her.

Roberts a youthful octogenarian would like to make a gift to the University of California to support undergraduate programs. Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. Sample Annuity Rates for Gift Amount of 20000.

Charitable gift annuities as with all things have benefits and risks. Age Payment Rate Annuity Deduction. State tax liability is not.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. Fox example future income payments are subject to the ability of the.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12027 the amount of the 25000 donation. Age of One Beneficiary. Example assumes a 34 percent applicable federal rate AFR and a federal income tax bracket of 35.

You should also be aware that the joint gift annuity. Dear XXXX Thanks so much for requesting information about how to make a gift and receive income for life through our Planned Giving Partnership with The Community. 7 rows For example if you created a 100000 gift annuity at age 70 you could expect to receive.

Summary of Benefits for Alice Gift Annuity. Sample Annuity Rates for Gift Amount of 25000.

Statue Of Diana By Anna Hyatt Huntington In Brookgreen Gardens South Carolina Sculpture Sculptures Sculpting

The Woolworth Lunch Counter Chairs From The Greensboro North Carolina Sit In Are Exhibited At The Museum

Charitable Gift Annuities The University Of Texas At Austin

Planned Giving Hays Medical Center Foundation

Charitable Gift Annuity Gift Planning Giving To Williams

How Charitable Gift Annuities Can Be A Useful Tool For Some Retirees

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Pin On Higher Ed Marcomm Ideas

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Uja Federation Of New York Planned Giving Charitable Gift Annuity

Making Gifts Again Part 2 Accelerating Charitable Gift Annuities Wealth Management

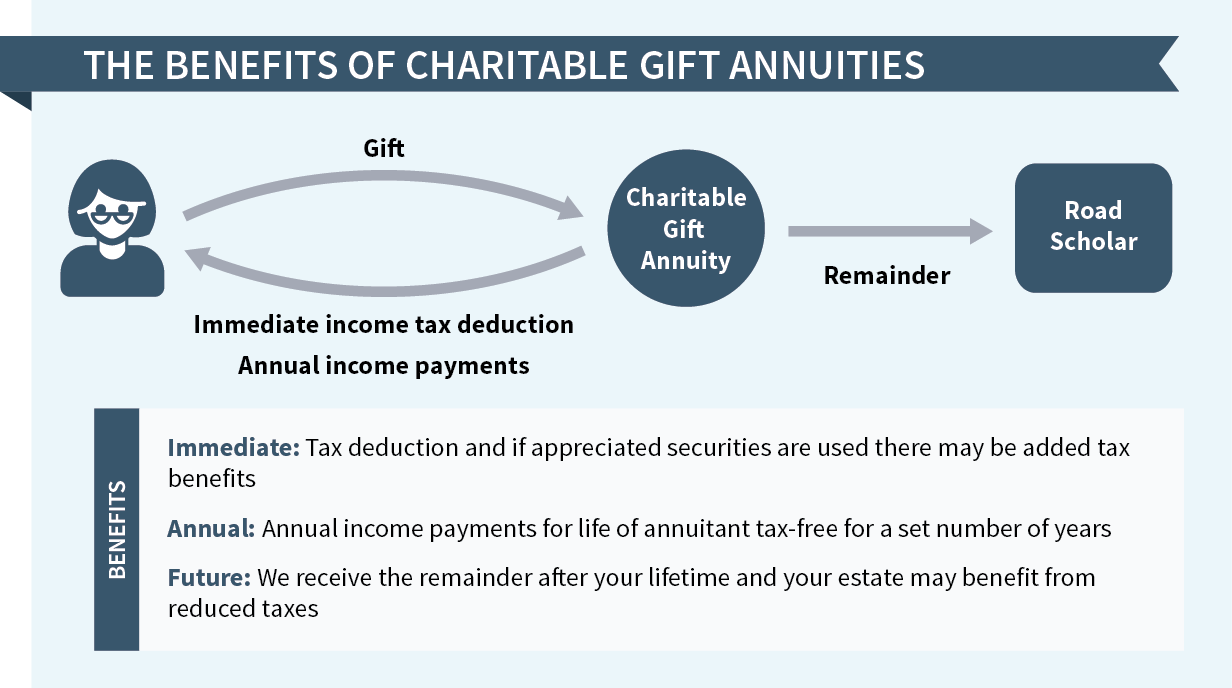

Charitable Gift Annuities Road Scholar

Pin On Higher Ed Marcomm Ideas

Found On Bing From Ovdf Org Brochure Examples How To Plan Brochure

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center