alaska sales tax on services

The move is in response to a 2018 Supreme Court decision known as the Wayfair ruling that said that states may charge sales tax on purchases made from out-of-state sellers. This lookup tool is provided by the Alaska Remote Seller Sales Tax Commission ARSSTC.

Why Hb 1628 S Sales Tax On Services Is Bad For Maryland Maryland Association Of Cpas Macpa

There are few exceptions to the application of sales tax and it is the.

. States New Hampshire Oregon Montana Alaska and Delaware do not impose any. This guide is designed to provide an overview of the complexity of sales tax on services by state. In reaction to the 2018 South Dakota.

47 cents per gallon. The two largest cities Anchorage and Fairbanks do not charge a local sales tax. The Alaska AK statewide sales tax rate is currently 0.

State of Alaska Department of Revenue For corrections or if any link or information is inaccurate or otherwise out-dated please email The Webmaster. There are additional levels of sales tax at local jurisdictions too. In contrast to the national average the average effective property tax rate in the state is 118 which is 011 higher.

Out of state sales tax nexus in Alaska can be triggered in a number of ways. Therefore if you are a business entity subject to sales taxes within the state you will. The State of Alaska does not levy a sales tax.

State Substitute Form W-9 - Requesting Taxpayer ID Info. 32 cents per gallon. 2022 Alaska state sales tax.

Alaska is one of the five states in the USA that have no state sales tax. Alaska Aviation Fuel Tax. There are however several municipal governments that do.

Skip to main content. With local taxes the total. 31 rows The state sales tax rate in Alaska is 0000.

District of Columbia State of Alaska Sales Tax Exemption PDF Tax Information. Alaska Remote Seller Sales Tax Commission - opens in new window or tab. The City of Adak levies a sales and use tax of on all sales rents and services made in the city at the rate of 4.

Welcome to the Alaska Sales Tax Lookup. The current statewide sales tax rate in Alaska AK is 0. 47 cents per gallon.

Alaska sales tax details. Alaska has a destination-based sales tax system so you have to pay. Individual towns have broad discretion over tax rates and sales taxes can be as high as 75 percent.

At present the State of Alaska does not levy a sales tax. Individual municipalities have wide authority to set their own taxation rates and sales tax can be as high. 9 cents per gallon.

Register with Munirevs with Alaska. The City of Wasilla collects a 25 sales tax on all sales services and rentals within the City unless exempt by WMC 516050 see the Sales Tax Exemption page for information about. In Alaska the median property tax rate is 242200 for a.

There are however several municipal governments that do. The Alaska state sales tax rate is 0 and the average AK sales tax after local surtaxes is 176. This can be accomplished by either enrolling in our Done-for-You Sales Tax Service or by completing the necessary forms on the.

And travel services for State government. While there is no state sales tax in Alaska boroughs and municipalities are. The state capital Juneau has a 5 percent sales tax rate.

Local taxing authoritieslike cities and. The fuel vendors pay the taxes though the. Alaska Jet Fuel Tax.

Understand how your online business can be exposed to tax risk. The state-wide sales tax in Alaska is 0. Statewide sales tax rate Economic Sales Threshold.

Alaska does not impose a state level sales tax however eBay is required to collect sales taxes in certain Alaska. The state constitution and other. Alaska - Tax Division.

32 cents per gallon. Exact tax amount may vary for different items.

Where Amazon Collects Sales Tax Map Excel Grid

How Do State And Local Sales Taxes Work Tax Policy Center

Amazon Tax Vs Existing State Use Taxes American History Timeline Accounting Services Tax

Understanding California S Sales Tax

How To Charge Sales Tax In The Us 2022

Sales Tax By State Is Saas Taxable Taxjar

Accounting And Tax Services Flyer In 2022 Tax Services Bookkeeping Services Accounting Services

Sales Tax Vs Use Tax How They Work Who Pays More

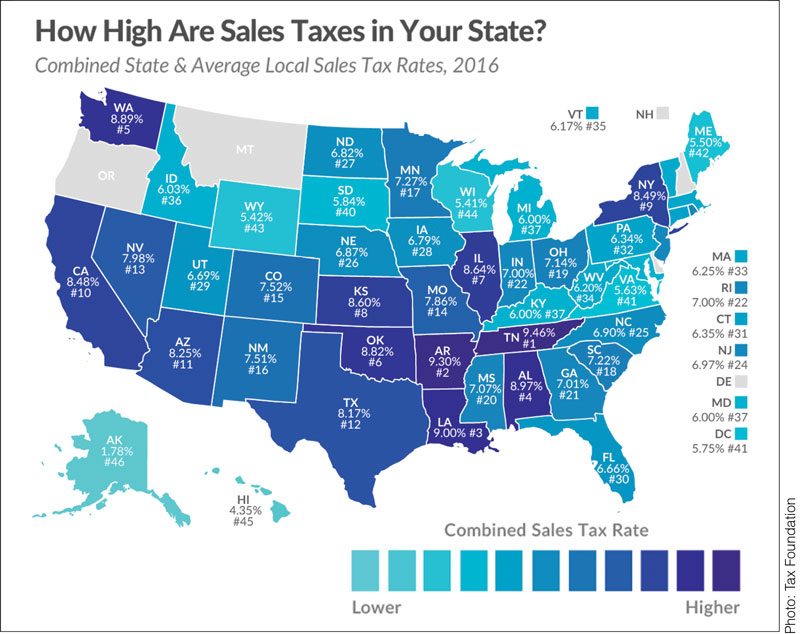

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Avoid Penalties By Staying Aware Of Sales Tax Laws

Sales Allocation Methods The Cpa Journal Method Journal Cpa

How To Charge Sales Tax In The Us 2022

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax States

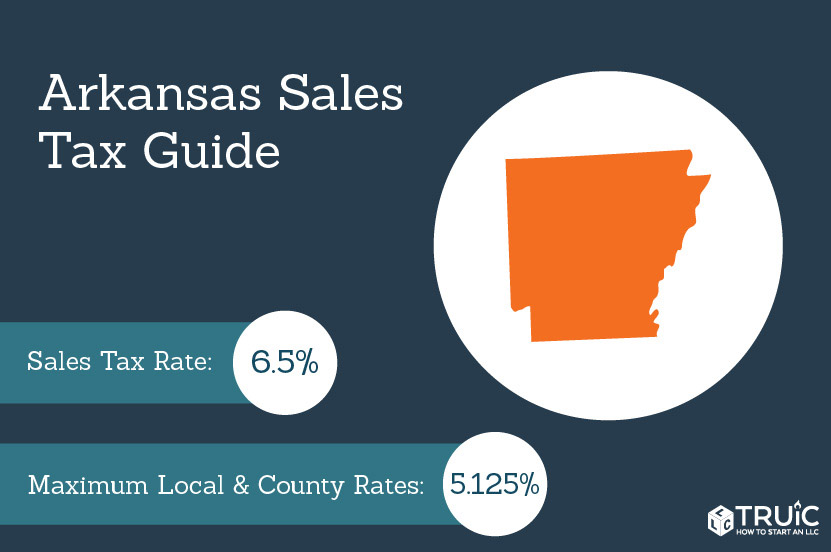

Arkansas Sales Tax Small Business Guide Truic